We're going to make 2015 the year we make over our finances.

As I mentioned a few weeks ago in my 2015 resolutions post, one of our big goals for this year is to get our finances into tip-top shape so that we can buy/build a home in early 2016. Our financial situation is in no way bad...I would consider us very average for our age and income. However, just like most everybody out there, we definitely have some things we need to do to kind of spruce up the overall outlook.

This means some small changes, like giving up little luxuries (daily coffee shop visits, manicures, fast food) and frequently checking in on our monthly budget. But it also means some big changes, like eliminating the use of our credit cards. We don't have a lot of credit card debt, but it's there...and it nags at me. It is just annoying and unnecessary to have outstanding credit card debt, not to mention expensive. So, the very first thing on our list this year is to get rid of it.

We all know how easy it can be to fall into a high-interest credit card trap. You miss a payment...your rate is sky-high. Your one-year introductory fee is over...your rate goes way up. You go over your limit...your rate is through the roof. You get the idea - and if you've ever had to deal with high-rate credit cards, it can feel like an impossible situation to escape.

Applying for their services is so easy.

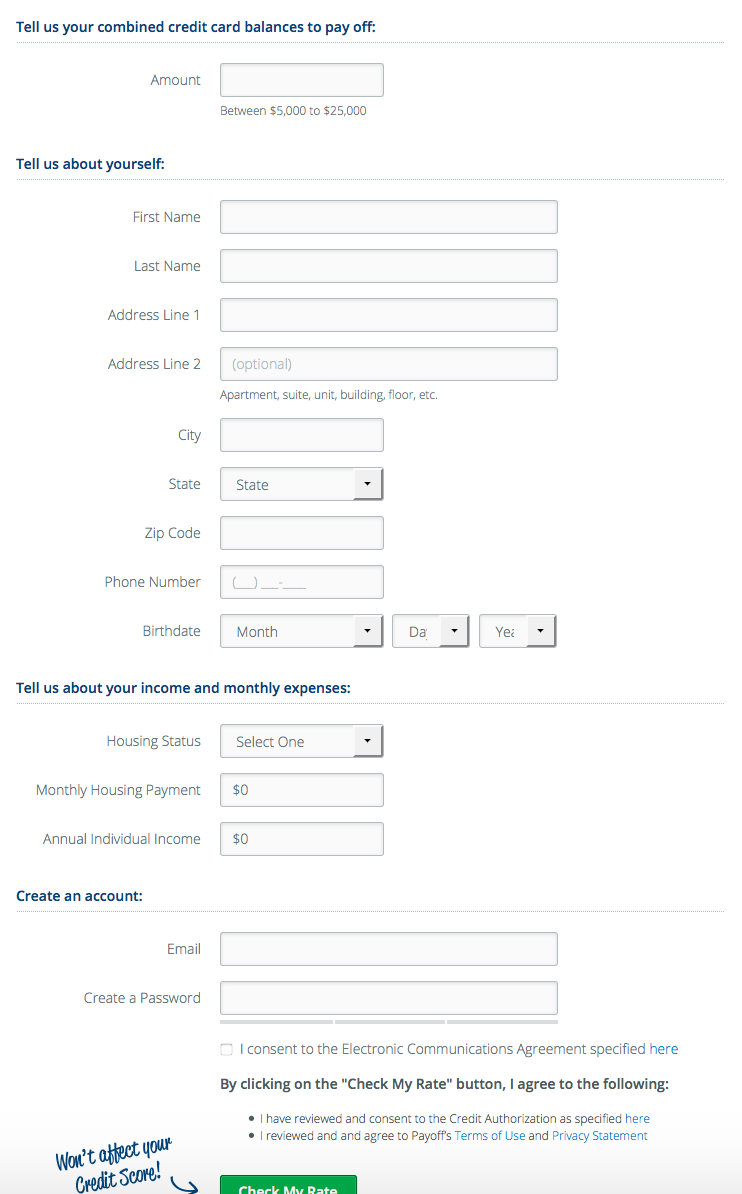

Simply visit their website and click the green button in the top right corner to apply.

Fill out this easy form and have the people at Payoff work their magic. That's it...really! This form doesn't affect your credit store and can be completed in under 5 minutes. You also don't have to worry about paying application fees or pre-payment fees with this. Once the people at Payoff evaluate your financial situation, they provide qualified applicants with a variety of offers, and you pick which one works for you.

If you don't qualify for their loan services, Payoff.com offers a program called "Lift." It's designed to help you get control over simple areas of your financial life through credit and money education. Their goal really is to help customers succeed through financial products and education in how to manage money.

Who knew that making over your finances was as simple as sitting down at your computer for a few minutes? I just love this modern age sometimes.